Motus Sustainability Loan

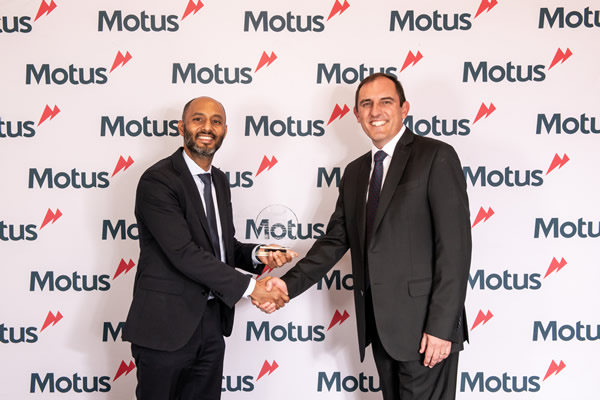

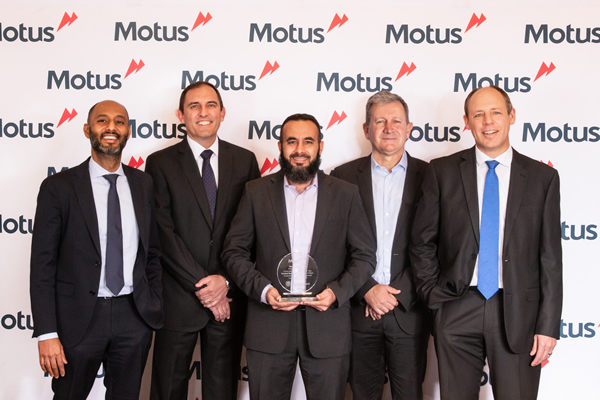

Motus and Standard Bank secure SA’s First ZAR ESG Syndicated Sustainability-Linked Facility

(JOHANNESBURG, SOUTH AFRICA) June 2022

In a first for the sector, leading automotive group, Motus Holdings Limited (Motus) has secured a syndicated ZAR 6 billion sustainability-linked facility (facilitated by Standard Bank) and a ZAR 800 million sustainability-linked working capital facility from Standard Bank. This ground-breaking ZAR-denominated environmental, social and governance (ESG) facility will enable the next phase of Motus’ ESG journey. It will focus on the fuel used by group vehicles , water and electricity consumption, as well as gender equality to drive diversity and inclusion.

Having secured international ESG linked facilities in January 2020, the latest ZAR 6.8 billion reaffirms Motus’ ongoing commitment to ensure ESG principles and outcomes are integrated with its strategy and performance for sustained growth.

“We are pleased to be able to work with partners who have developed innovative products to integrate our sustainability values with responsible capital market participants. Our commitment to the targets recognises our ongoing investment and evolution to ensure that we reduce carbon emissions and contribute to social challenges to ensure a better and more sustainable business” said Osman Arbee, CEO of Motus.

“Standard Bank is focused, primarily through its Sustainable Finance division, on providing financial products and services that support positive ESG outcomes, including green and social bonds, sustainability-linked loans and bonds, sustainable trade and working capital solutions and impact investing,” said Lungisa Fuzile, CEO of Standard Bank South Africa.

“Our partnership with Motus affirms our commitment to mobilise between R250 billion and R300 billion in sustainable finance by the end of 2026. We are therefore delighted and proud to partner with Motus in supporting their growth ambitions while also contributing to transformation in our economy,” added Fuzile.

“As we enter our 75th year of operations, our commitment to ESG practices and principles, will ensure we remain a sustainable and valuable contributor to our customers, employees, supply chain partners and the communities in which we operate,” concluded Arbee.

Sustainability-linked facilities tie the terms of funding to ESG outcomes to support and incentivise responsible corporate behaviour and the creation of shared value. As Motus achieves its Key Performance Indicators (KPIs), it receives an incentive in the form of a favourable interest rate benefit and vice versa should it not achieve its KPIs.